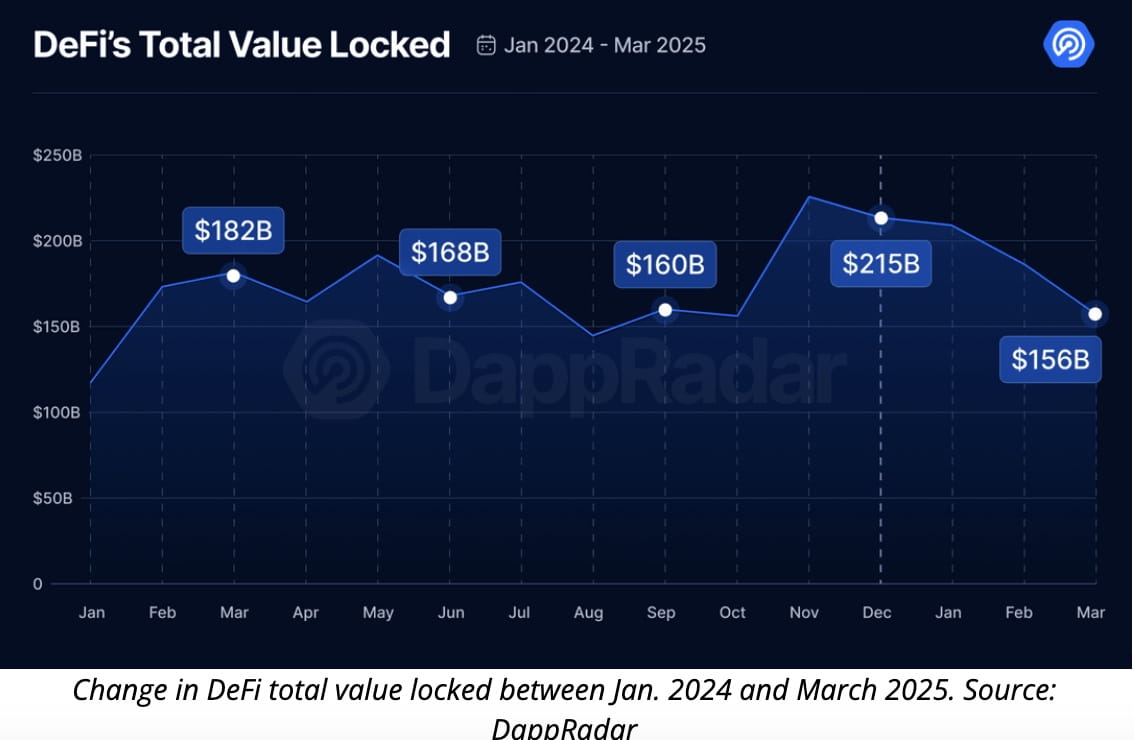

The decentralized finance (DeFi) sector suffered a sharp decline in Q1 2025, with total value locked (TVL) plunging 27% to $156 billion, according to a new DappRadar report released April 3.

The decrease is indicative of a broader decline in crypto markets as a result of ongoing macroeconomic uncertainty and the aftermath of a significant breach on the cryptocurrency exchange Bybit.

Sui Lead TVL Declines,

Ethereum DeFi TVL’s largest blockchain, Ethereum, saw a 37% decrease in locked assets to $96 billion, while Sui experienced the steepest decline among the top 10 chains, dropping 44% to $2 billion. Other major blockchains such as Solana, Tron, and Arbitrum also recorded over 30% drops in TVL.

DappRadar says that chains with fewer stablecoin reserves and more withdrawals of tokens were under more pressure, which increased the impact of falling token prices like Ether (ETH), which fell 45 percent to $1,820 during the quarter. Berachain is the only one who succeeds.

The newly launched Berachain defied the downtrend in a surprising way by accumulating $5.17 billion in TVL between February 6 and March 31. In the first quarter, it was the only top-10 blockchain to report positive TVL growth.

The use of AI and social protocols rises.

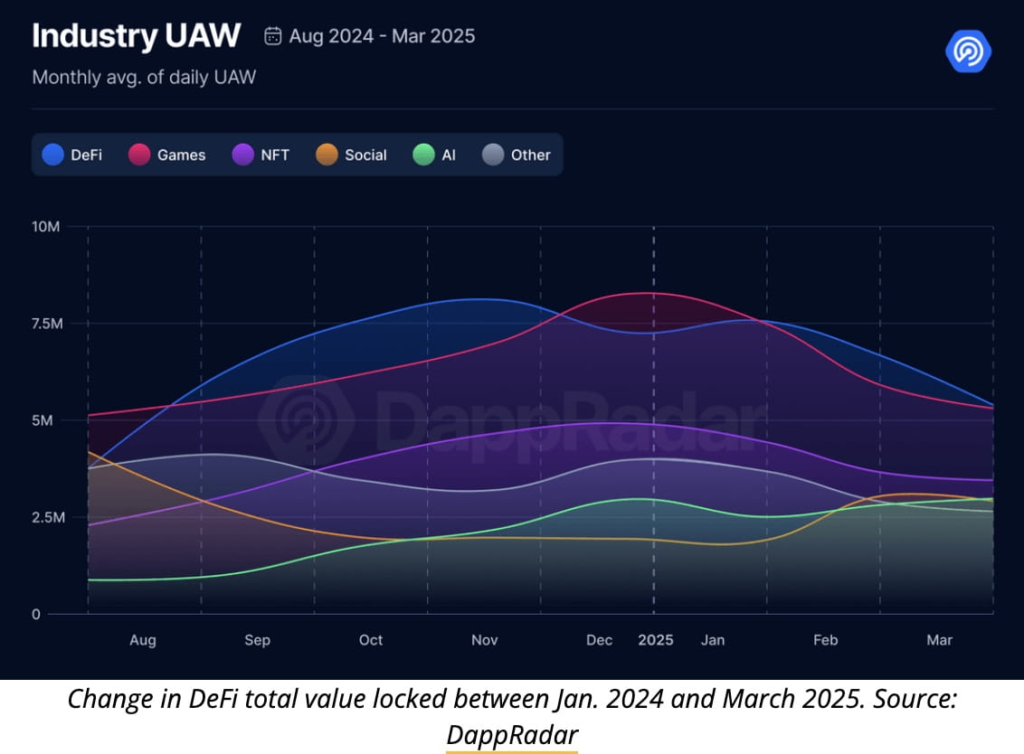

AI and social applications grew while the DeFi, NFT, and GameFi industries shrank. Daily Unique Active Wallets (DUAW) interacting with AI protocols increased by 29%, and user activity in social dapps increased by 10%.

DappRadar emphasized the “explosive growth” of AI-powered agent protocols, stating that they have advanced beyond the concept stage and are now shaping user behavior in the real world. The monthly average DUAW for AI and social protocols climbed to 2.6 million and 2.8 million, respectively.

GameFi and NFT Display Weakness NFT trading volume dropped 25% to $1.5 billion, led by:

$599 million OpenSea Blur: $565M

According to Cointelegraph, Pudgy Penguins had the highest volume of NFT sales with $177 million, while CryptoPunks remained elite with $63.6 million from just 477 sales, demonstrating their continued prestige despite being less accessible.