Trading volumes are declining and marketplaces shutting down.

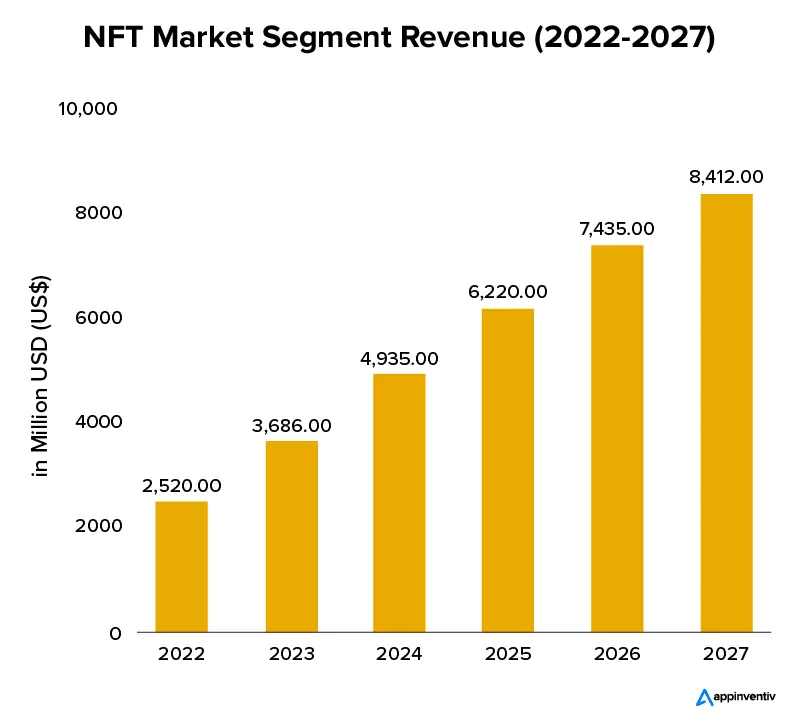

Analysts once boldly predicted that the market for non-fungible tokens could reach $264 billion by 2032, but it now appears to be limping along. Over the course of several weeks, weekly trading volumes have been falling like dominoes, scaring away capital and bringing the market back to levels it hasn’t seen since its explosive debut in 2020.

Blockchain analytics firm DappRadar shows that trading volumes in 2021 were riding high, hitting nearly $3 billion.

In the first quarter of 2025, fast forward. That figure has nosedived 93% to just $23.8 million as “active traders have vanished,” blockchain analyst Sara Gherghelas noted.

“This rapid growth occurred at the same time as global shifts brought on by the COVID-19 pandemic, which accelerated the adoption of digital platforms and pushed artists to investigate novel approaches to engaging their audiences. However, three years later, the hype around Art NFTs has significantly decreased.

Sara Gherghelas

She is supported by the data. Trading volume decreased by nearly 20% in 2024, while total sales decreased by 18%. As Gherghelas put it in her 2025 research, it was “one of the worst-performing years since 2020.”

Assets that are still speculative OutsetPR’s legal officer Alice Frei said in an interview with crypto.news that regulation is still a mess because “governments are still undecided on how to classify NFTs.” Because they are frequently treated as securities in the United States, platforms must navigate a legal minefield. In the U.K., they’re seen more like collectibles under intellectual property law.

These are leading nations with clear cryptocurrency regulations; the situation is even more uncertain in many other nations. Investor confidence is harmed and an environment that is ripe for fraud is created by this lack of regulatory clarity. Until there is more consistency, NFT adoption will remain stagnant.”

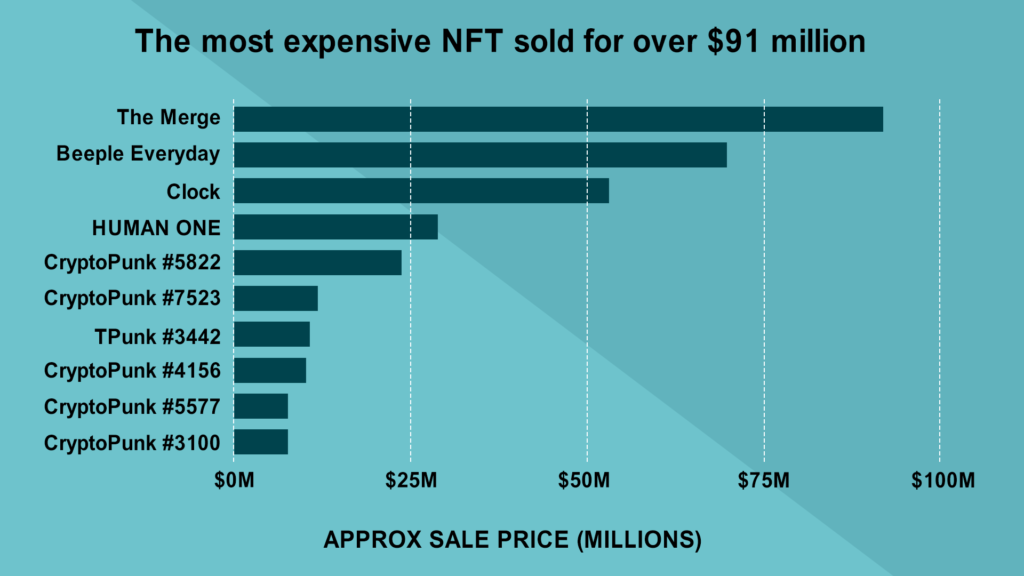

Frau Frei Frei also highlighted a deeper issue: beyond the worlds of cryptocurrency and gaming, NFTs are still “trying to prove that they offer real value.”

“In theory, they could revolutionize several industries — think concert tickets that prevent scalping, digital IDs for online verification, or property deeds stored on the blockchain. However, in reality, the majority of NFTs are still primarily speculative assets. Frau Frei Speaking of gaming, where NFTs have the most potential for mainstream use, their adoption is also struggling, Frei pointed out, recalling that Ubisoft’s Project Quartz, an attempt to integrate NFTs into AAA games, was met with “resistance from players, forcing the company to shut it down.”

According to Frei, gamers are “hesitant about digital assets that feel more like a genuine addition to their experience than a genuine form of currency.”

Revolving door In case the data weren’t bad enough, a series of market closures in March added fuel to the fire. Among them, South Korean tech giant LG shut down its LG Art Lab, which was launched just three years ago at the height of the NFT mania. The company only stated that “it is the right time to shift our focus and explore new opportunities.” It did not provide any specific justifications. A week later, X2Y2, a former rival of OpenSea that had a lifetime volume of $5.6 billion, also shut down, citing a “90% shrinkage of NFT trading volume from its peak in 2021” and difficulties remaining competitive in the market. Bybit came next. The cryptocurrency exchange quietly shut down its platform in the wake of a $1.46 billion theft linked to hackers affiliated with North Korea.

Bybit’s web3 director Emily Bao stated that the move would enable the company to “enhance the overall user experience while concentrating on the next generation of blockchain-powered solutions.” According to Frei, the NFT market now “feels like a revolving door” in light of the flurry of closings. Take, for instance, Bored Ape Yacht Club, whose prices have significantly decreased since it reached the pinnacle of NFT status. A single bored ape sold for $400,000 at its peak, while some now only fetch $50,000.

The problem lies in the fact that many NFT projects rely on hype rather than actual utility. People are unlikely to return if they cannot see long-term value. Frau Frei Last chance Coinbase, too, seems to be pulling back. While it hasn’t officially shut down its NFT platform, all signs suggest it’s shifting focus. Emilie Choi, President and COO, said on an earnings call in early 2023 that the company sees “medium and long-term opportunities” in NFTs. But its real focus seems to be behind Base, its layer-2 blockchain network.

Despite numerous requests from crypto.news, Coinbase declined to comment on its position as NFT activity continues to decline. The OutsetPR legal officer thinks that with the market’s current trajectory, smaller platforms are unlikely to weather the storm.

She stated, “Smaller platforms will continue to close, leaving only a few dominant players like Blur and OpenSea.” She explained that the shift is being driven by two major forces. First, the “Wild West days of NFTs” are likely to come to an end thanks to tighter regulations. Second, the gaming sector may offer NFTs a lifeline—but it’s still a narrow one. As Frei puts it, gaming may be NFTs’ “last hope,” though developers will still need to avoid “pay-to-win mechanics that could turn players away.”

“The hype is over. If NFTs are to survive, they will need to prove that they offer more than just expensive pictures on the blockchain,” Frei concluded.